Glossary

For a larger glossary of many terms used in property appraisal, please see the International Association of Assessing Officers' Glossary for Property Appraisal and Assessment .

PAAA

Property Appraisal and Assessment Administration.

Paid

This is the amount of tax posted as paid for the year in question, either in installment payments or full payment. If you have paid funds that do not yet show paid, contact the Treasurer's Office at 602-506-8511.

Parcel

An area of land, of any size, that is capable of being conveyed by a single legal description in one ownership.

Parcel Legal Description

The legal description of a parcel's location and shape.

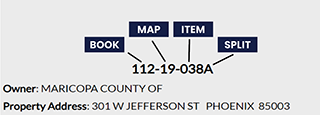

Parcel Number (APN)

Each parcel is given a unique number to identify it. This number is listed on your Notice of Value and can be used to search for your property on the Assessor's and Treasurer's websites. The number consists of three to four parts which gradually identify parcels with more specificity. The first three digits of the number are the Assessor's book number which covers large parts of the county. The next two digits are the Assessor's map number which is the map within the book. Finally, the last three digits are the Assessor's item number identifying the specific property. Sometimes, when the parcel has been split, you will see a letter after the last three numbers identifying which part of the split it is.

Partnership

A business arrangement in which two or more persons jointly own a business and share in its profits and losses.

Patio Quantity

The number of covered patios and/or concrete slabs.

Patio Type

Covered patio, concrete slab, both, or none.

Penalty Assessment

A penalty for failure to file a Business Property Statement with the Assessor within the prescribed time. The penalty is equal to 10% of the assessed value of the unreported property.

Physical Condition

An indicator of the overall condition of the primary structure.

Physical Deterioration

A cause of depreciation which is a loss in value due to wear and tear and the forces of nature.

Planned Unit Development

A type of residential, commercial, and/or industrial land development in which buildings are clustered or set on lots that are smaller than usual, and large, open park like areas (common areas) are included within the development. Individual properties are owned in fee with the joint ownership (directly or through a homeowner's organization) of open space areas. Also referred to PUD.

Plat

- A plan, map, or chart of a city, town, section, or subdivision indicating the location and boundaries of individual properties

- A map or sketch of an individual property that shows property lines and may include features such as soils, building locations, vegetation, and topography.

Plot Plan

A plan showing the layout of improvements on a property site or plot; usually includes location, dimensions, parking areas, landscaping, and other features.

Point of Beginning

A survey reference point that is tied into adjoining surveys. In a metes and bounds description, courses that connect monuments or points are generally described from this point. Also referred to as POB.

Pool

Whether or not the parcel includes an in-ground swimming pool.

Pool Area

The square footage of the water surface of pools and spas (if any).

Potential Gross Income

The total gross income at 100 percent occupancy. Also referred to as PGI.

Power of Attorney

A legal instrument in which a person authorizes another to act as his or her attorney or agent.

Price

Amount paid for an item.

Private Encumbrances

Private hindrances that affect value and sale price such as: easements, condominium controls, and deed or subdivision restrictions.

Property

Property includes an aggregate of things, or rights to things, which are protected by law. There are two basic types of property: real and personal. The Assessor assesses real estate (land and improvements), and taxable personal property.

Property Address

The physical address of the parcel of property.

Property Class

A descriptive code that identifies the type of property.

Property Tax Levy

The total amount of money to be raised from the property tax as set forth in the budget of a taxing jurisdiction.

Property Use Code (PUC)

The Property Use Code (PUC) is determined by the Assessor to identify how the property is being used. The full list of the codes is maintained by the Arizona Department of Revenue and are uniform across the State. A parcel's PUC reflects the predominant use of the property even if there are multiple uses of the property.

The first two digits of the use code reflect the general type of property use while the third digit will identify major subcategories of that use. The fourth digit, if used, will be to represent a very specific use. Use codes are used by many different users ranging from the Assessor to cities and even private or commercial users.

PU Description

A brief explanation of the property use code associated with the parcel. Comprehensive explanations are available in the Arizona Department of Revenue Property Use Code Manual.